Montage Enters into Agreement with Barrick and Endeavour to Expand Koné Gold Project and Arranges $20 Million Bought Deal Financing

June 8, 2022

Vancouver, British Columbia — June 8, 2022 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCPK: MAUTF) is pleased to announce that it has entered into an agreement (the “Agreement”) with a subsidiary of Barrick Gold Corporation (“Barrick”) and a subsidiary of Endeavour Mining plc (“Endeavour”), pursuant to which Montage will acquire a 100% interest (the “Transaction”) in the Mankono-Sissédougou Joint Venture Project (as described below, and referred to as “Mankono”), which consists of three properties contiguous to the Company’s Koné Gold Project (“KGP”) in Côte d’Ivoire. Under the terms of the Agreement, Montage will acquire 100% of the issued and outstanding shares of Mankono Exploration Limited (a Jersey Company) (“MEL”), which indirectly holds Mankono, for total consideration of C$30,000,000 comprised of C$14,500,000 in cash, 22,142,857 common shares of Montage, and the granting of a 2% NSR royalty (allocated 70% to Barrick and 30% to Endeavour based on their relative ownership interest in MEL).

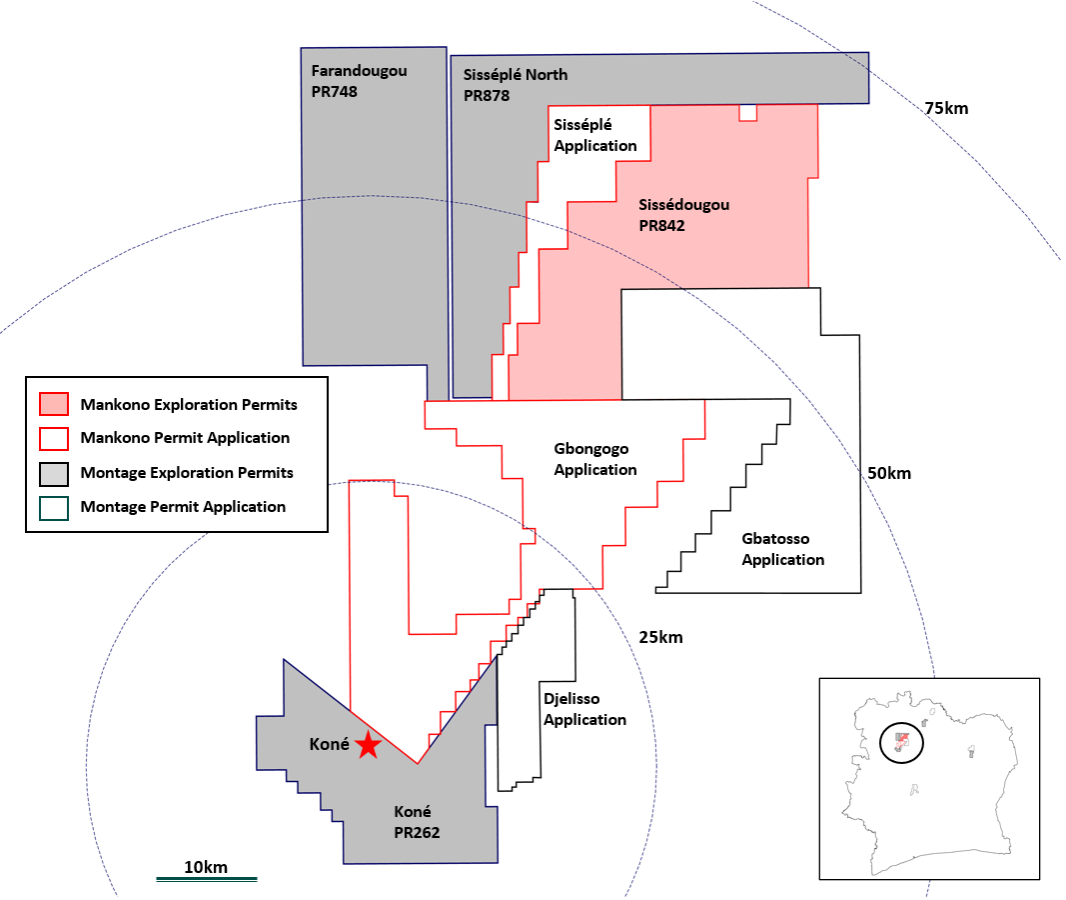

Closing of the Transaction is subject to, among other things, the granting by the government of Côte d’Ivoire of the Gbongogo Exploration Permit which is currently an exploration permit application which has been submitted by a subsidiary of MEL (see Figure 1). Closing of the Transaction is expected to occur within six months of this announcement.

HIGHLIGHTS

- Mankono property package adds 893km2 to the Koné Gold Project

- Consolidates land position to 2,259km2 of contiguous ground

- All areas within haulage distance of proposed Koné mill location

- US$20M in historic exploration spend with extensive database

- Over 65km of soil anomalies defined

- Exploration of Mankono will target high-grade satellite potential

- Montage welcomes Barrick and Endeavour as new shareholders

- Barrick and Endeavour to own 9.93% and 4.26% of Montage, respectively, post-closing

- Transaction cash consideration to be funded via C$20 million bought deal private placement of subscription receipts

Hugh Stuart, Montage CEO, commented, “This is an important step for Montage, with the addition of Mankono, our consolidated land position at the Koné Gold Project will increase to over 2,250km2 in one of the most prolific gold belts in West Africa. Previous exploration at Mankono has identified a number of target areas and Montage intends to explore these targets aggressively with the objective of adding high grade satellite feed into the KGP”.

DETAILS

Transaction and Financing Overview

Montage has signed a definitive share purchase agreement (the “Agreement”) with Barrick and Endeavour pursuant to which Montage will acquire 100% of the outstanding shares of MEL in exchange for total consideration (the “Consideration”) of C$30,000,000, consisting of C$14,500,000 in cash and 22,142,857 common shares of Montage (priced at C$0.70 per common share), plus a 2% NSR royalty. The Consideration will be split pro-rata on a 70/30 basis between Barrick and Endeavour.

Closing of the Transaction is subject to, among other things, the award of the Gbongogo Exploration Permit, which is currently in application (see Figure 1). The application has passed the inter-ministerial subcommittee process and the Transaction is expected to close as soon as the permit is formally awarded. The Agreement provides for an outside closing date of December 7, 2022, unless otherwise extended by the parties.

The Company has entered into an agreement with Stifel GMP on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters have agreed to purchase, on a bought deal private placement basis, approximately 28.6 million subscription receipts (the “Subscription Receipts”) priced at C$0.70 per Subscription Receipt, for gross proceeds of approximately C$20.0 million (the “Financing”). The Financing is expected to close on July 7, 2022.

The Company intends to use the net proceeds of the Financing to pay the cash portion of the consideration payable pursuant to the Transaction and to fund the business plan of the Company in respect of the acquired properties following closing of the Transaction.

Each Subscription Receipt shall be deemed to be exchanged, without payment of any additional consideration, into one common share of the Company upon the satisfaction of certain conditions, which includes the closing of the Transaction (the “Release Conditions”).

The gross proceeds from the sale of the Subscription Receipts less 25% of the Underwriters’ fee will be deposited and held in escrow by Endeavour Trust Company, as subscription receipt and escrow agent, pending the satisfaction or waiver of the Release Conditions. If the Release Conditions are not satisfied or waived prior to December 7, 2022 (the “Termination Date”), the escrowed proceeds will be returned to the holders of Subscription Receipts, and the Subscription Receipts will be cancelled and have no further force and effect.

The gross offering price of the Subscription Receipts will accrue interest for the benefit of the Subscription Receipt holders as follows:

- 10.0% per annum, payable in cash (the “Cash Interest”) on the earlier of (i) the satisfaction of the Release Conditions; and (ii) the Termination Date; and

- 6.0% per annum, payable in common shares (the “Interest Shares”) to be issued at the then current “Market Price” (as defined in the TSXV Corporate Finance Manual), on the two month anniversary of the closing of Financing and on each subsequent two month anniversary of the prior Interest Shares payment date (each such two month period, a “Bi-Monthly Period”) until the earlier of (i) the satisfaction of the Release Conditions; and (ii) the Termination Date; provided that no such interest shall accrue, and no Interest Shares will be issuable for any partial Bi-Monthly Period.

The Subscription Receipts will not be listed on any stock exchange, though the Company has applied to list the common shares issuable upon exchange of the Subscription Receipts and the Interest Shares on the TSX Venture Exchange, which application remains subject to the approval of the TSX Venture Exchange.

The 2% NSR royalty (the “Royalty”) will apply only to the permits and applications that currently comprise Mankono (see Figure 1) and will be subject to a 1% buyback at the option of Montage for a period of two years for a price of US$10 million. The Royalty will be documented under two separate agreements, whereby Barrick will receive a 1.4% royalty and Endeavour a 0.6% royalty, reflecting their respective pro rata entitlements.

Upon completion of the Transaction (and assuming the exchange of Subscription Receipts for common shares), Montage will issue a total of 50,714,286 common shares and will have a pro forma share count of 156,054,290 issued and outstanding common shares.

Insiders of the Company are expected to participate in the Financing. Pursuant to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the Financing constitutes a “related party transaction” to the extent that insiders of the Company subscribe for Subscription Receipts. The Company is relying on exemptions from the formal valuation and minority approval requirements of MI 61-101, specifically: (i) the valuation requirement of MI 61-101 by virtue of the exemption contained in Section 5.5(b), as the common shares are not listed on a market specified in MI 61-101, and (ii) the minority shareholder approval requirement of MI 61-101 by virtue of the exemption contained in Section 5.7(1)(a) of MI 61- 101, as the fair market value of the Subscription Receipts and the Escrow Interest being issued and paid to insiders will not exceed 25% of the Company’s market capitalization (as determined under MI 61-101). The Financing was approved by all of the independent directors of the Company.

The securities issued pursuant to the Financing and the Transaction are subject to a four-month hold period under applicable Canadian securities laws commencing on the closing date of the Financing or the Transaction, as applicable.

Overview of Mankono-Sissédougou Joint Venture Project

Mankono consists of the Sissédougou Exploration Permit (PR842, 387km2) issued in 2019, the Gbongogo permit application and the Sisséplé permit application (400km2 and 106km2 respectively), all lying within the perimeter of Montage’s Koné Gold Project as shown in Figure 1.

Taken together with Montage’s existing land holdings they form a contiguous block of 1,295km2 in Exploration Permits and a further 964km2 in exploration permit applications for a total of 2,259km2.

The Gbongogo permit application area has been explored by Randgold (Barrick) since 2013 and the Sissédougou and Sisséplé areas by Endeavour and previously La Mancha Resources since 2010. The Mankono Joint Venture was as formed in 2017 and exploration has been managed by Barrick since that time, with Barrick owning 70% of MEL as operator and Endeavour owning 30%.

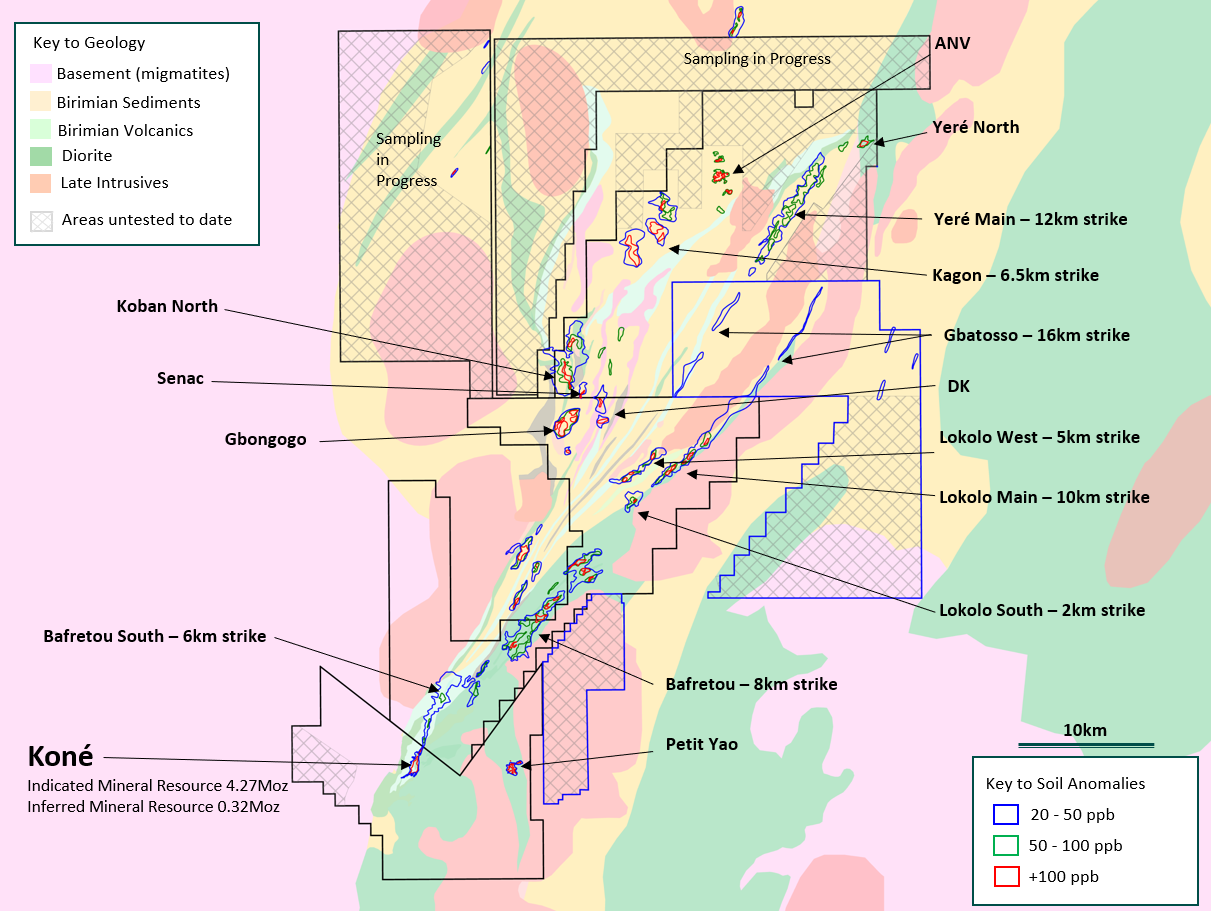

The database of the historic work includes over 36,000 soil samples, 15,500m of trenching and 31,000m of air core drilling. Notably only 6,000m of Reverse circulation (“RC”) drilling and 8,560m of diamond core drilling has been completed most of which is on the Gbongogo prospect. Historic exploration spending on the combined land package by all parties is approximately US$20 million. Further details of the historic database will be released by the Company once all validation steps are taken and ownership of the data transfers to Montage at Closing.

Figure 2 shows the extensive soil anomalism on the Mankono land package, which totals over 65km in linear strike length including multiple anomalies grading over 100ppb in large areas. Montage intends to explore these target areas aggressively following Closing. Details of planned drilling and other exploration activities will be disclosed by the Company at Closing.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, which currently hosts a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold. The Company released the results of a definitive feasibility study (the “DFS”) on the Koné Gold Project on February 14, 2022, outlining a 15-year gold project producing 3.06M ounces of gold with average annual production of 207koz, and peak production of 320koz. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa.

TECHNICAL DISCLOSURE

The mineral reserve estimate for the Koné Gold Project was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd. who is considered to be independent of Montage. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under National Instrument 43–101 (“NI 43-101”). The DFS was prepared by Lycopodium Minerals Pty Ltd. and incorporates the work of Lycopodium and Specialist Consultants, under the supervision of Sandy Hunter, MAusIMM(CP), of Lycopodium, a Qualified Person pursuant to NI 43-101 who is independent of Montage.

For further details of the data verification undertaken, exploration undertaken and associated QA/QC programs, and the interpretation thereof, and the assumptions, parameters and methods used to develop the mineral reserve estimate for the Koné Gold Project, please see the DFS, entitled “Koné Gold Project, Côte d’Ivoire Definitive Feasibility Study National Instrument 43-101 Technical Report” and filed on SEDAR at www.sedar.com. Readers are encouraged to read the DFS in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The DFS is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical contents of this press release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London. Mr. Stuart is not independent of Montage as he is an officer, director and shareholder of Montage.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the timing of closing of the Transaction, the terms and conditions of the Financing, the Company’s resource properties and resource estimates, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions, including those set out in the DFS. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s continuous disclosure documents filed from time to time on SEDAR. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.